Credit Card

Earn 1% cash back on payments: Revvi Card review

Build your credit score quickly and enjoy this Visa card wide acceptance! Keep reading and learn more about the Revvi Card and its main features!

Advertisement

Qualify with poor credit!

In this Revvi Card full review, you’ll discover a new way to build credit while earning rewards confidently!

Apply for the Revvi Card

Apply for the Revvi Card today and earn 1% cash back on payments! Start building credit with confidence! Instant result application!

So stay with us, learn how this credit card works, and find out whether it is the right option for you! Keep reading and learn more!

| Credit Score | Bad – Fair; |

| Annual Fee | $75 in the 1st year. $48 after; |

| Purchase APR | 35.99%; |

| Cash Advance APR | 35.99%; |

| Welcome Bonus | N/A; |

| Rewards | Earn 1% cash back on purchases. |

Revvi Card: All you need to know

Revvi Card offers a simple and quick solution to those who want to build or rebuild their credit scores! It reports monthly to credit bureaus!

In addition, it provides fast application and decision. Cardholders can also use a user-friendly mobile app to easily manage their card!

Also, if you want to look closer at your credit score-building process, don’t worry! Revvi Card offers free credit monitoring through TransUnion!

And we can’t forget the best part: you’ll earn a 1% cash back reward on payments. This cashback can be easily redeemed through Revvi mobile app.

Indeed, you can enjoy all this with a Visa credit card, which offers wide acceptance anywhere!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Revvi Card

Revvi Card is a straightforward credit card! It is destined for those eager to build their credit scores while earning rewards!

But before you decide, let’s review Revvi Card main features and compare its pros and cons below!

Pros

- All types of credit are welcome to apply;

- Earn 1% cash back on payments with this card;

- Easy-to-use mobile app;

- This card helps you build credit;

- Enjoy free credit score monitoring services.

Cons

- This card charges a one-time once you’re approved;

- Potentially high APR;

- The annual fee is higher in the 1st year.

What credit score do you need to apply?

As a credit builder card that won’t offer several features, the Revvi Card has no strict credit score requirement.

This means that it accepts applicants with poor and limited credit scores! But remember that having a higher credit can improve your approval odds.

And once you’re approved, you can start building it with confidence.

How to easily apply for the Revvi Card?

As you can note in our full review, the Revvi Card is an excellent choice to build credit easily!

To learn how to apply for it, stick with us! The following article will explain the step-by-step process in detail! So let’s get started!

Apply for the Revvi Card

Apply for the Revvi Card today and earn 1% cash back on payments! Start building credit with confidence! Instant result application!

About the author / Luis Felipe Xavier

Trending Topics

Things that might happen if you don’t use your credit card!

Have you ever wondered what happens if you don't use your credit card? Don't worry! We'll explain everything your need here! Keep reading!

Keep Reading

Instant decision: Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Keep Reading

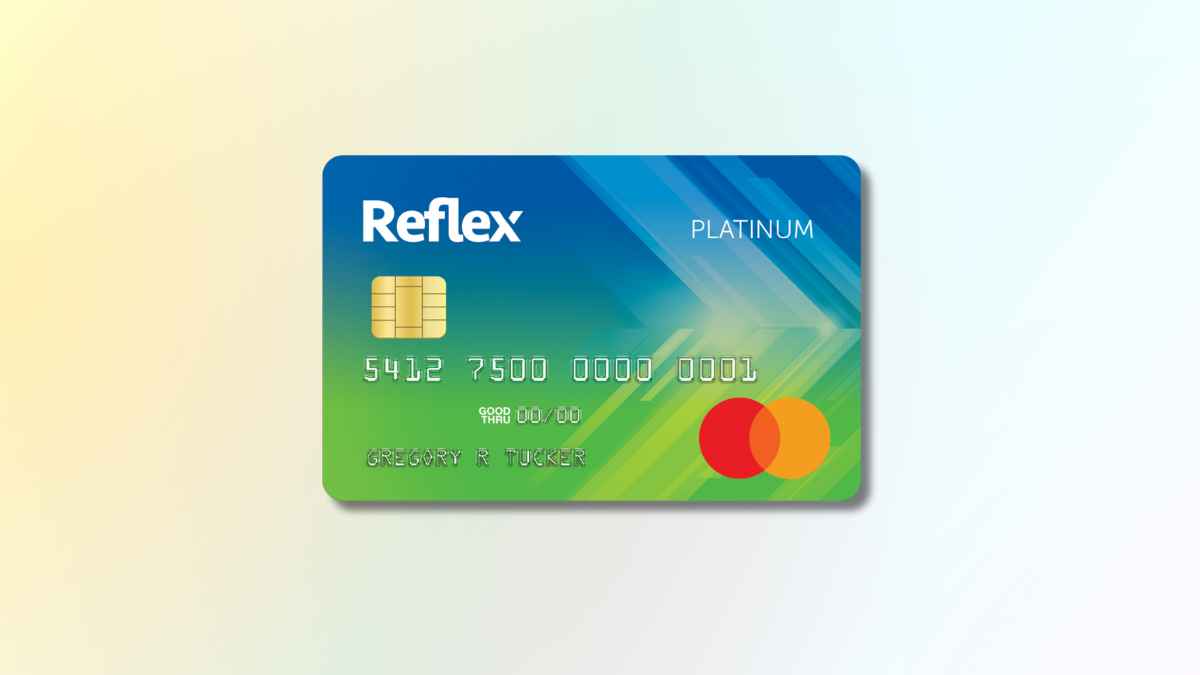

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep ReadingYou may also like

GO2bank Secured Visa® Credit Card review: Build credit fast

Explore our GO2bank Secured Visa® Credit Card review and discover a smart way to boost your credit journey - no credit check!

Keep Reading

Credit builder: Apply for First Digital Mastercard® Credit Card

The process to apply for the First Digital Mastercard® Credit Card is simple and quick! Earn 1% cash back on payments and build credit fast!

Keep Reading

Apply for the Upgrade Loans: Borrow Up to $50,000

Learn how to apply for Upgrade Loans and benefit from low-interest rates and flexible terms with our step-by-step guidance.

Keep Reading