Need quick funds with an easy, reliable lending process?

Secure your Rocket Personal Loans for fast, straightforward financing solutions – up to $45,000

Advertisement

Rocket Personal Loans shines in making borrowing easy, offering a quick way to get money with an easy online application, fair rates, and the chance to choose how much you need. They cut through the red tape, avoiding complex steps or loads of paperwork. Whether for surprise expenses, a dream project, or debt consolidation, they’re a go-to solution.

Rocket Personal Loans shines in making borrowing easy, offering a quick way to get money with an easy online application, fair rates, and the chance to choose how much you need. They cut through the red tape, avoiding complex steps or loads of paperwork. Whether for surprise expenses, a dream project, or debt consolidation, they’re a go-to solution.

You will remain in the same website

Discover how Rocket Personal Loans can fuel your financial growth! Dive in below to uncover the perks that make borrowing a breeze.

Discover the world of Rocket Personal Loans, a lending solution that opens doors to financial opportunities.

Whether you’re seeking funds for home improvements or a major life event, Rocket offers a range of benefits and considerations to help you make an informed borrowing decision.

Advantages and special perks

- Flexible Loan Amounts: Borrowers can request loan amounts ranging from $2,000 to a substantial $45,000, catering to various financial needs.

- Competitive APR Range: Rocket Personal Loans feature competitive interest rates, spanning from 9.12% to 29.99%, ensuring affordability.

- Pre-Qualification: Get started with a soft credit check for pre-qualification, allowing you to gauge your eligibility without affecting your credit score.

- Rate Discounts: Enjoy rate reductions by enrolling in autopay, simplifying your loan management and saving you money.

- Fast Funding: Rocket’s efficient processing ensures swift access to the money you need, minimizing waiting times.

- Flexible Repayment Terms: Choose from two flexible repayment term options—3 or 5 years—aligning your loan with your financial goals.

- Transparent Origination Fee: While there is an origination fee between 1.49% to 8.48% of the loan amount, Rocket ensures transparent fee structures.

- No Early Payoff Penalty: Gain financial freedom with the option to repay your loan early without incurring penalties.

- Direct Payments: For debt consolidation loans, note that direct payments to creditors are not available.

- Credit Prerequisite: To qualify for Rocket Personal Loans, you’ll need a credit score of at least 640.

Disadvantages

- Origination Fee: The presence of an origination fee, though transparent, can be considered a minor drawback.

- Limited Term Options: Rocket offers just two repayment term choices—3 or 5 years—limiting flexibility.

- No Co-sign or Joint Loans: If you’re looking for co-sign or joint loan options, Rocket Personal Loans does not provide this feature.

- Late Fee: Be aware that late fees amount to $15, emphasizing the importance of timely repayments.

In conclusion, Rocket Personal Loans offers a versatile lending solution with competitive rates, flexible loan amounts, and transparent terms.

While the presence of an origination fee and limited-term options may be considered drawbacks, the benefits make it a viable choice for borrowers with various financial needs.

After securing your Rocket Personal Loan, you can manage your loan directly through the Rocket Loans login portal on their website. This dedicated space allows borrowers to check their balance, make payments, and view their payment history, providing a seamless way to keep track of financial obligations. It’s a one-stop virtual hub for your loan management needs, accessible anytime, anywhere.

Rocket Personal Loans emphasizes their direct service, which means the application process happens through their official website rather than through a third-party loan app. By doing so, Rocket maintains the security of your personal information and ensures you’re getting the accurate representation of their terms, rates, and benefits directly from the source.

Absolutely, Rocket Personal Loans specializes in efficiency, understanding that some financial needs are urgent. Their streamlined application process can give you a response quickly, and upon approval, the transfer of online loan money can even happen within the same business day. This makes it a reliable option for those unexpected emergencies that require immediate financial attention.

Apply for the Rocket Personal Loans

Take a leap forward when you apply for the Rocket Personal Loans. Featuring instant decisions and hassle-free online application.

Rocket Personal Loans stands out for quick funding, offering a streamlined online process. However, there’s more in the lending world.

Consider Upgrade Personal Loans, a viable alternative with unique perks. They offer competitive rates and a transparent process.

Upgrade isn’t just a loan provider; they’re a financial wellness company. Tools for tracking credit and understanding finances set them apart.

Curious about these benefits? Dive deeper into what Upgrade offers and see how their approach could suit your needs. Discover more below!

Apply for the Upstart Personal Loans

See how to apply for Upstart Personal Loans and unlock amounts up to $50,000 with terms to match your unique financial situation.

Trending Topics

How many mortgages can you have? A guide for investors

Are you an investor looking to maximize your returns? Discover how many mortgages you can have and the best strategies for utilizing them!

Keep Reading

Apply for First Progress Platinum Prestige Secured Card: 1% back

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

Keep Reading

Apply for the Group One Platinum Card: No Credit Checks

Discover how to apply for the Group One Platinum Card and enjoy effortless shopping with a significant credit limit and no credit checks.

Keep ReadingYou may also like

Upgrade Loans review: Quick Approvals, Easy Process

Check our Upgrade Loans review to explore low rates and flexible terms that cater to your financial needs. Unlock smarter borrowing

Keep Reading

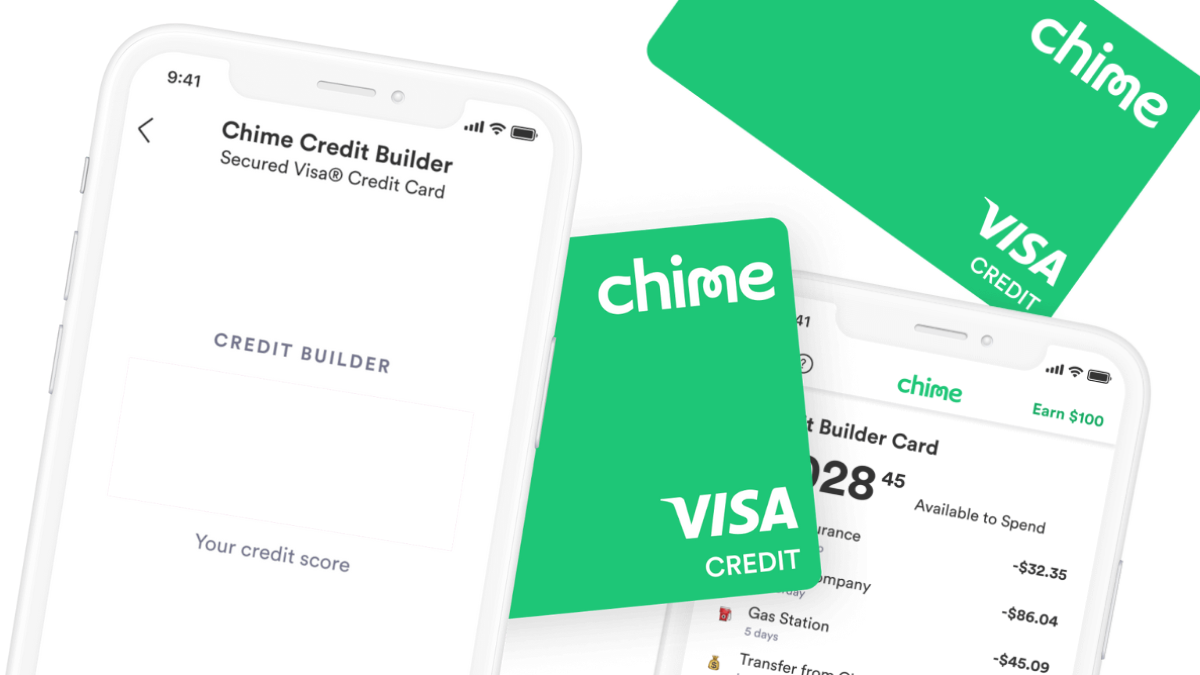

$0 annual fee: Chime Credit Builder Secured Visa® Card review

Looking for a new credit card with no credit check and no interest? Then read our Chime Credit Builder Secured Visa® Card full review!

Keep Reading

Apply for the PenFed Power Cash Rewards Visa Signature® Card

Apply for the PenFed Power Cash Rewards Visa Signature® Card today and earn up to 2% cash back! $0 annual fee! Read on and learn more!

Keep Reading