Debit Card

PayPal Prepaid Mastercard® review: Earn Payback Rewards

Discover the ins and outs of secure spending with our PayPal Prepaid Mastercard® review. Get to know insights to make the most of your financial management.

Advertisement

Empower your wallet and use the card anywhere Mastercard® is accepted

Uncover savvy spending with our PayPal Prepaid Mastercard® review. Get the lowdown on how this card reshapes your financial flexibility.

Apply for the PayPal Prepaid Mastercard®

Ready to take control of your finances? Learn how to apply for the PayPal Prepaid Mastercard® and enjoy secure, hassle-free spending.

From online shopping to in-store splurges, we’ll guide you through its perks and quirks. Further, navigate money matters with confidence!

| Credit Score | It being a prepaid card, there are no minimum requirements. |

| Annual Fee | $4.95 monthly fee. |

| Purchase APR | N/A. |

| Cash Advance APR | N/A. |

| Welcome Bonus | There are no welcome offers or bonuses. |

| Rewards | You can earn Payback Rewards on qualifying purchases. |

PayPal Prepaid Mastercard®: All you need to know

Unlock the gateway to effortless spending with the PayPal Prepaid Mastercard®. Say hello to a world of financial flexibility.

Indeed, being prepaid, this Mastercard welcomes all applicants, making financial transactions accessible to everyone.

By enrolling in the Payback Rewards program, you can have access to points and exclusive offers. That way, your spending becomes rewards.

The PayPal Prepaid Mastercard® comes with a monthly fee of $4.95 – an investment into a system that offers you control, security, and convenience.

Also, you can add funds with ease through NetSpend Reload ATMs or directly from your PayPal account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the PayPal Prepaid Mastercard®

Ready to dive deeper? Then explore our PayPal Prepaid Mastercard® review below.

So let’s unveil the crucial advantages and potential drawbacks to guide your financial journey.

Pros

- Usable anywhere Mastercard is accepted.

- No credit check since it’s prepaid.

- Enroll in the Payback Rewards program to earn points and get special offers.

- Direct deposit offers access to funds 2 days earlier.

- Add funds via PayPal or NetSpend Reload ATMs.

- Manage your card on-the-go with PayPal’s mobile app.

Cons

- The card incurs a $4.95 charge each month.

- Being prepaid, it doesn’t build your credit history.

- Additional charges for ATM withdrawals may apply.

- Unlike credit cards, it offers limited purchase protection.

What credit score do you need to apply?

Indeed, one of the enticing aspects of the PayPal Prepaid Mastercard® is its accessibility.

You don’t need any specific credit score to apply for this card because it’s a prepaid option.

Since it’s not a credit card, your credit history isn’t scrutinized.

Thus, everyone can apply, making it a fantastic financial tool for managing spending without delving into credit.

How to easily apply for the PayPal Prepaid Mastercard®?

Curious about expanding your financial tools after exploring our First Latitude Secured Mastercard® Credit Card review?

Learn how to step into a stress-free application journey by following the link below. Your path to smart, secure spending with insightful guidance is just a click away.

Apply for the PayPal Prepaid Mastercard®

Ready to take control of your finances? Learn how to apply for the PayPal Prepaid Mastercard® and enjoy secure, hassle-free spending.

Trending Topics

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep Reading

Apply for the Best Egg Personal Loans: Quick Cash, Zero Hassles!

Ready to transform your finances? Apply for Best Egg Personal Loans easily and embrace convenient, reliable funding for your peace of mind.

Keep Reading

Apply for the Avant Personal Loans: Fund Your Dreams Fast!

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Keep ReadingYou may also like

Piggyback loan: how it works, pros and cons

A piggyback loan can help you buy a home without paying for private mortgage insurance. Find out what benefits it offers and the drawbacks.

Keep Reading

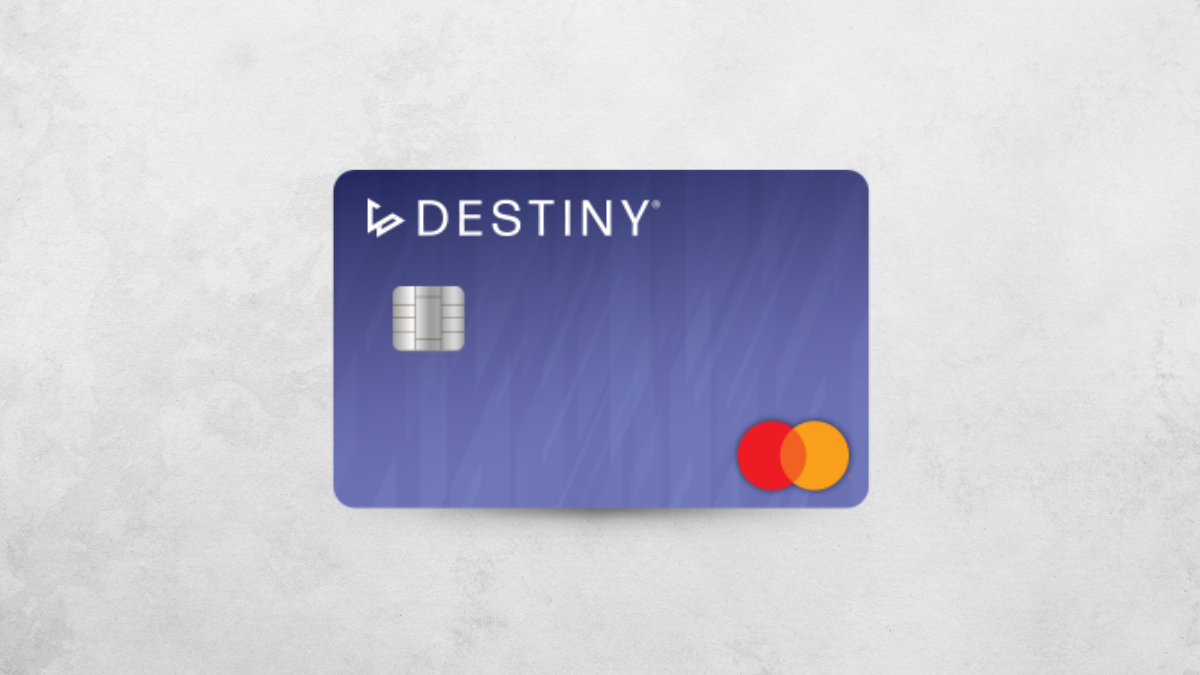

How to apply for the Destiny Mastercard®: Response in 60 seconds

Ready to shape your financial future? Learn how to apply for the Destiny Mastercard® today and step forward with confidence!

Keep Reading

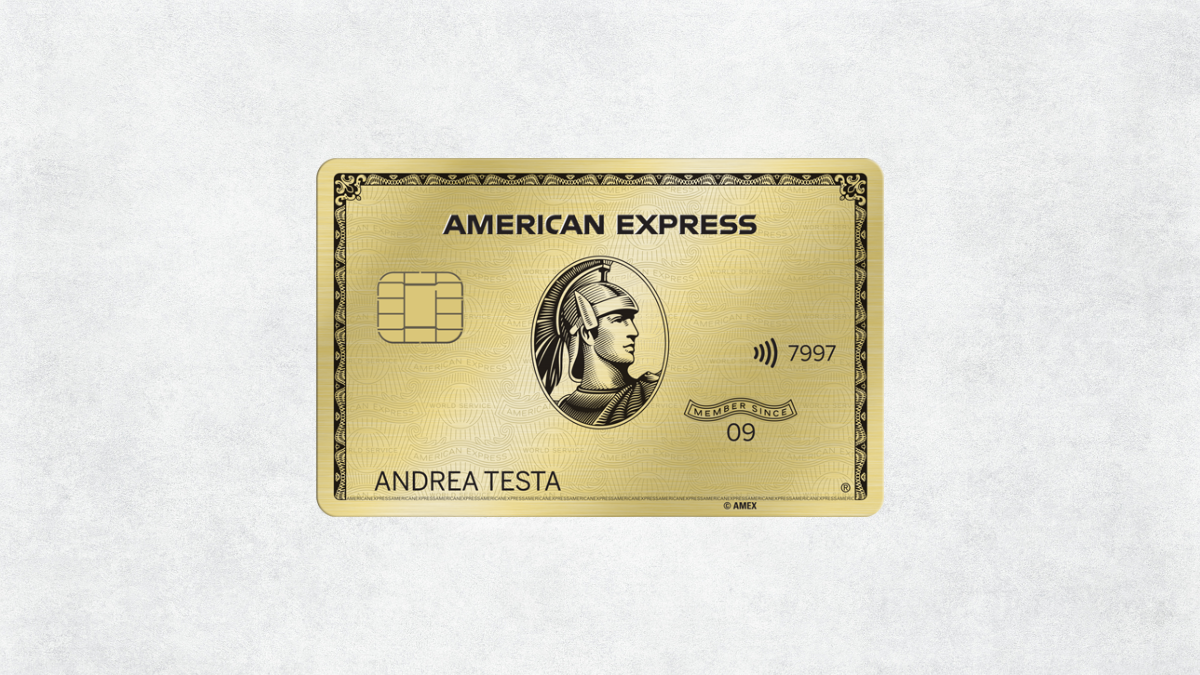

Recensione Carta di Credito Oro American Express: Ci sei arrivato

Il modo più economico per vivere la tua esperienza con la Carta di Credito Oro American Express. Zero anuità il primo anno!

Keep Reading