Need a simple and rewarding way to build or rebuild your credit efficiently?

The First Latitude Secured Mastercard® Credit Card offers an easy entry to all and gives you 1% cash back on card payments!

Advertisement

Unlock financial empowerment with First Latitude Secured Mastercard® Credit Card! Boasting cash back rewards, credit building capability, and a straightforward application process, it’s your accessible gateway to better credit. Enjoy the freedom and embrace new opportunities with a card designed to support and enhance your financial journey.

Unlock financial empowerment with First Latitude Secured Mastercard® Credit Card! Boasting cash back rewards, credit building capability, and a straightforward application process, it’s your accessible gateway to better credit. Enjoy the freedom and embrace new opportunities with a card designed to support and enhance your financial journey.

You will remain in the same website

Explore the key to financial freedom with the First Latitude Secured Mastercard® Credit Card! Discover its benefits below.

Are you ready to embark on a journey towards financial empowerment? The First Latitude Secured Mastercard® Credit Card could be your ideal companion.

Advantages and special perks

- Mastercard Worldwide Acceptance: With Mastercard’s global network, you can confidently use this card in countless locations around the world.

- Straightforward Application: The application process is designed to be hassle-free, making it accessible to individuals looking to establish or rebuild their credit.

- Cash Back Rewards: Enjoy the satisfaction of earning cash back on your everyday purchases. This card offers a tangible benefit for your spending.

- Credit Building Power: Start on the path to better credit. Your responsible use of this card is reported to credit bureaus, aiding in the growth of your credit score.

- Security Deposit Flexibility: Depending on your financial situation, you can choose the security deposit amount that works for you, which will determine your credit limit.

Disadvantages

- Security Deposit Required: As with all secured credit cards, an initial security deposit is necessary. While this is refundable, it might be a barrier for those with limited funds.

- Potential Fees: Be aware of any annual fees or other charges associated with the card. Carefully read the terms and conditions.

- Security Deposit Tie-Up: The security deposit you provide as collateral is essentially locked while you have the card. If you’re working with a tight budget, tying up a significant amount of money in the deposit can be a drawback, as it might limit your available funds for other purposes.

Embrace the journey, seize the opportunity, and pave your way to a better financial tomorrow with this credit-building card.

Yes, the First Latitude Secured Mastercard® Credit Card is issued by Synovus Bank, and the security deposit you make for the card is FDIC-insured up to $250,000. This practice ensures that, in the unlikely event of bank failure, your deposited funds are safeguarded up to the maximum amount allowed by law, providing additional security and peace of mind as you navigate your credit-building journey.

The First Latitude Secured Mastercard® Credit Card app allows you to manage your account conveniently from your mobile device. After downloading the app from your respective app store, you will utilize your credit card login credentials to access your account. Features include the ability to view your balance, check transactions, make payments, and more, providing a seamless digital management experience.

If you encounter issues with your credit card login, begin by ensuring that your login credentials are entered correctly. If difficulties persist, use the ‘Forgot Password’ or ‘Help’ options typically available on the login page. In case you’re still unable to access your account, contact customer service for further assistance to resolve the issue, ensuring that you can manage your card, track spending, and make payments smoothly online.

Yes. For those interested in utilizing digital wallet features, the First Latitude Secured Mastercard® Credit Card is compatible with Apple Pay, enabling users to make secure, contactless payments using their Apple devices. This feature not only provides a seamless and convenient transaction experience but also offers an additional layer of security as card details are not stored on your device or shared during payment.

The First Latitude Secured Mastercard® Credit Card is a fantastic tool designed to empower your credit journey, ensuring financial growth and stability.

Apply for First Latitude Secured Mastercard®

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

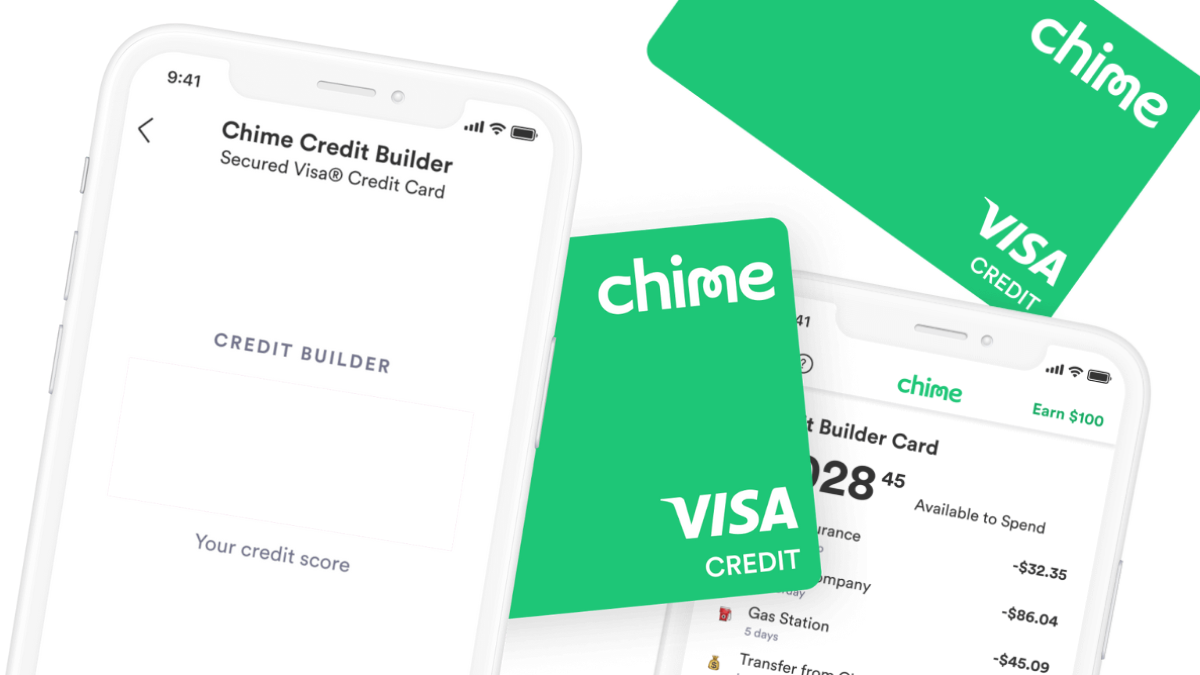

But if you’re considering alternatives, meet the Chime Credit Builder Secured Visa® Card – a fee-free, reliable choice that also brings credit building to your fingertips.

Curious to learn more? Then, explore the application process for the Chime Credit Builder Secured Visa® Card by following the link below.

Apply for the Chime Credit Builder Secured Visa®

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Trending Topics

Best Egg Personal Loans Review: Better Financial Flexibility!

Uncover financial freedom with our Best Egg Personal Loans review. Experience lightning-fast approval for stress-free money management!

Keep Reading

Can an Overdraft Affect Your Credit Score?

Does overdraft affect your credit score? Learn facts and tips to protect your financial health and credit rating. Stay informed and secure.

Keep Reading

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Dive into our Wells Fargo Reflect® Card review to uncover its unique benefits and features. Experience 0% intro APR today!

Keep ReadingYou may also like

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard®

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard® today and earn a mile for every dollar spent! Sign-up bonus of 50K miles!

Keep Reading

Up to 3% back: Amazon Rewards Visa Signature Card review

This Amazon Rewards Visa Signature Card review offers Amazon lovers an excellent card option! $0 annual or foreign transaction fees!

Keep Reading

FIT® Platinum Mastercard® review: Your Gateway to Better Credit

Dive into our FIT® Platinum Mastercard® review to discover how this credit builder card can elevate your financial journey. Learn more!

Keep Reading