Are you struggling with low credit and need quick cash solutions?

OneMain Financial Personal Loans provides accessibility, designed to accommodate your finances – up to $20,000!

Advertisement

Embark on a brighter financial journey with OneMain Financial Personal Loans. Tailored for those with low credit, these loans offer flexible payment options and swift approval processes. Experience transparent terms, and the unique option to secure loans for a lower rate. With compassionate lending, OneMain transforms borrowing into a stress-free experience. Dive in, and feel the ease of thoughtful financing.

Embark on a brighter financial journey with OneMain Financial Personal Loans. Tailored for those with low credit, these loans offer flexible payment options and swift approval processes. Experience transparent terms, and the unique option to secure loans for a lower rate. With compassionate lending, OneMain transforms borrowing into a stress-free experience. Dive in, and feel the ease of thoughtful financing.

You will remain in the same website

Ready for a financial game-changer? Discover below how OneMain Financial Personal Loans could be your ticket to budget-friendly borrowing.

Entering the world of OneMain Financial Personal Loans brings a blend of relief and potential growth.

Catering to a spectrum of credit scores, these loans offer a bridge over financially troubled waters. Let’s unravel the specifics that define this lending path.

Advantages and special perks

- Wide Acceptance: OneMain Financial opens doors for borrowers with low credit, embracing a range of credit histories.

- Loan Customization: Tailor your loan terms to fit life’s unpredictability, a boon in financial planning.

- Secured Options: Collateral can secure better rates, easing the usual high-cost concerns for risky borrowers.

- Swift Capital: Quick funding post-approval means you’re financially ready for life’s unexpected turns.

- Personal Interaction: Nationwide branches facilitate a human touch, countering the cold digital norm.

- Debt Payoff Support: They offer support for debt consolidation, making debt management more straightforward.

- Flexible Use of Funds: OneMain allows the use of the funds for various personal needs, ensuring borrowers can cover a range of expenses.

- Transparent Criteria: Clear qualification guidelines make the application process less daunting, helping applicants understand what’s expected.

Disadvantages

- Above-average Rates: Easy access comes at a cost, with rates that might overshadow the borrowing benefits.

- Extra Fees: Origination, late payment, and other fees can pile on, inflating the borrowing cost.

- Not Everywhere: Geographic limitations mean not everyone can enjoy OneMain’s services.

- Collateral Risk: Secured loans imply a risk of asset loss, a weighty consideration before commitment.

- Varied Rates: Interest rates and terms can vary significantly based on location, adding uncertainty to the mix.

- No Mobile App: The absence of a dedicated mobile application means managing your loan requires web access, potentially complicating on-the-go account monitoring.

In conclusion, OneMain Financial offers a lifeline, especially for those with credit challenges. However, the trade-off comes with costs and considerations.

Scrutinize the details, align them with your scenario, and decide if this path lights your financial way forward.

While OneMain Financial doesn’t offer traditional auto loans, you can use their personal loans for purchasing a vehicle. These loans provide flexibility without the restrictions often associated with specific auto loans, allowing you to purchase older or unique vehicles that might not qualify under typical auto lending programs.

Currently, OneMain Financial does not have a specific loan app. However, their website is mobile-friendly, and you can easily manage your account, make payments, and check your loan balance using your mobile device’s browser. This accessibility ensures you can manage your loan anytime, anywhere.

What sets OneMain Financial apart is their commitment to speed without compromising thoroughness. After a quick online application, borrowers might need to meet with a loan specialist to finalize details. This process ensures funds are disbursed rapidly, often within one to two business days following approval.

Apply for the OneMain Financial Personal Loans

Secure your financial needs; apply for OneMain Financial Personal Loans for quick funding solutions and accessible branch support near you.

OneMain Financial Personal Loans cater to a broad audience, especially those with lower credit scores. They offer a balanced mix of versatility and accessibility.

However, if OneMain doesn’t meet all your needs, consider Rocket Personal Loans. Known for their swift, user-friendly process, Rocket might be the alternative you’re searching for.

Rocket Personal Loans shine with features like flexible payment options and quick funding. Their intuitive platform simplifies the often complex journey of getting a personal loan.

Curious about how Rocket Personal Loans could propel your financial plans forward? Check the link below to dive into their offerings and see how straightforward applying can be.

Apply for the Rocket Personal Loans

Take a leap forward when you apply for the Rocket Personal Loans. Featuring instant decisions and hassle-free online application.

Trending Topics

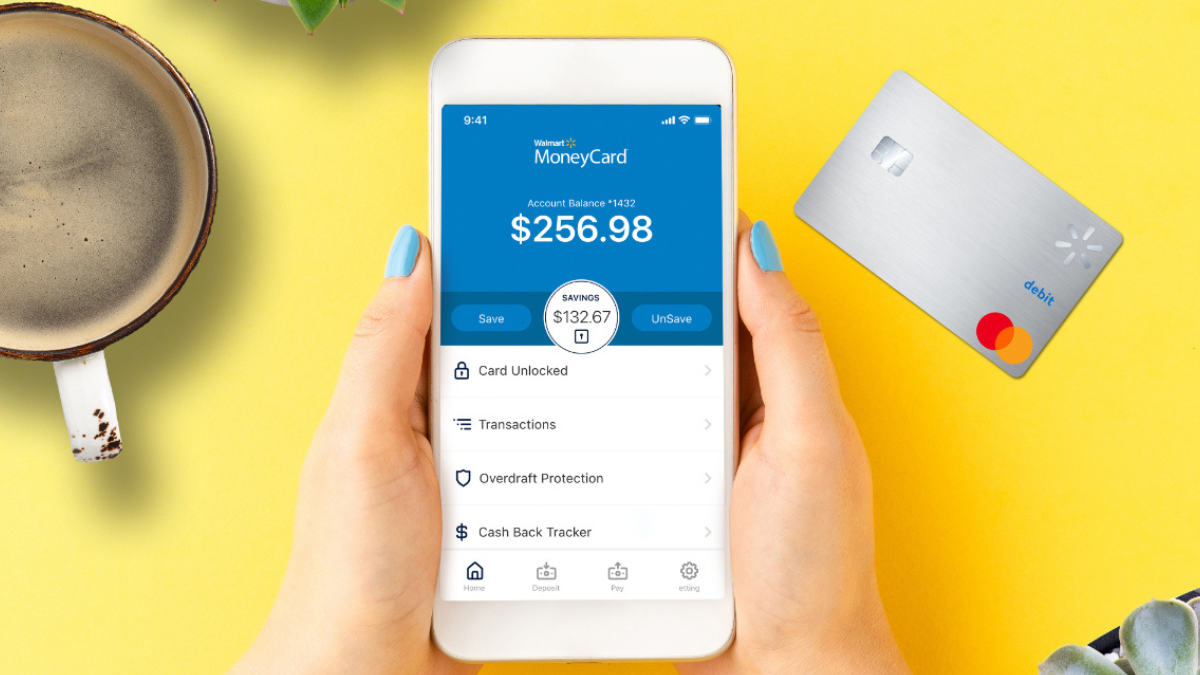

Walmart MoneyCard review: Earn cash back at Walmart

Explore our Walmart MoneyCard review to uncover features and how it can redefine your shopping experience today - earn 2% APY on savings.

Keep Reading

Citi® / AAdvantage® Executive World Elite Mastercard® review

Stick with us and review the Citi® / AAdvantage® Executive World Elite Mastercard® card's main features! Ensure 50K bonus miles and more!

Keep ReadingYou may also like

Apply for the PenFed Power Cash Rewards Visa Signature® Card

Apply for the PenFed Power Cash Rewards Visa Signature® Card today and earn up to 2% cash back! $0 annual fee! Read on and learn more!

Keep Reading

Choose Your 0% APR Credit Card: Maximize Your Savings on Interest

Discover the best 0% APR Credit Card for your needs. Our tips will guide you in choosing wisely. Learn more and make smart financial moves!

Keep Reading

Make Money Online: 10 Proven Ways

There are many ways to make money online, and one of these will certainly fit you. Put your pajamas back on and check our list!

Keep Reading