Need a credit line for shopping without a credit check?

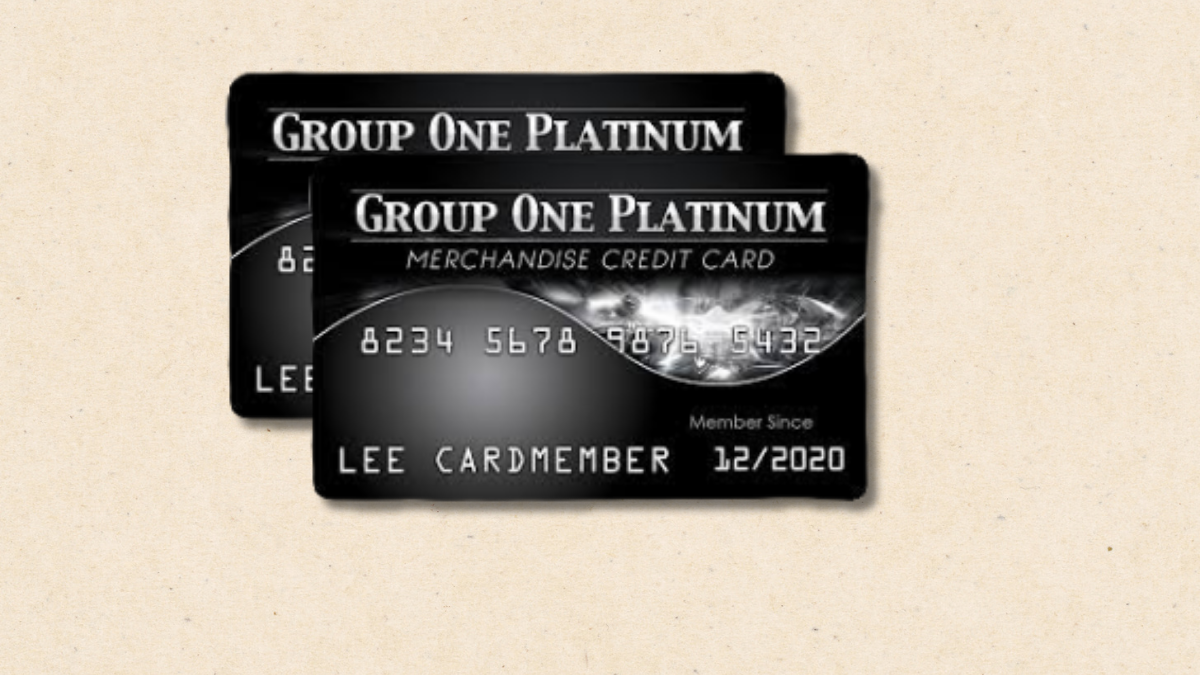

With the Group One Platinum Card, enjoy a $750 credit line and hassle-free shopping, even with no credit history!

Advertisement

Transform your shopping experience with the Group One Platinum Card. Designed for those with varying credit histories, it offers a unique opportunity to access a substantial credit line without the hassle of a credit check. Enjoy the freedom to shop at Horizon Outlet online with ease, supported by customer-focused services and exclusive online benefits.

Transform your shopping experience with the Group One Platinum Card. Designed for those with varying credit histories, it offers a unique opportunity to access a substantial credit line without the hassle of a credit check. Enjoy the freedom to shop at Horizon Outlet online with ease, supported by customer-focused services and exclusive online benefits.

You will remain in the same website

Discover how the Group One Platinum Card enhances your shopping experience with its unique benefits!

The Group One Platinum Card is a unique financial tool designed to simplify your online shopping experience.

This card stands out for those who seek an accessible credit option, offering a blend of convenience and simplicity.

Let’s delve into its comprehensive benefits and consider its drawbacks to give you a complete picture.

Advantages and special perks

- Approval Process: Approval is streamlined with no credit checks, opening doors for those with varied credit histories to easily obtain a credit line.

- Credit Line: Provides a $750 credit line, offering substantial purchasing power for a wide range of online shopping needs and desires.

- Application Ease: The application process is notably quick and user-friendly, ensuring immediate access to the card’s features and benefits.

- Online Shopping Focus: Designed exclusively for online use, it offers a secure and tailored shopping experience at the Horizon Outlet website.

- Member Perks: Members enjoy additional perks such as IDENTITY IQ, prescription discounts, legal assistance, and roadside protection plans.

- Spending Management: The card is an excellent choice for individuals looking to manage their spending without the temptation of cash advances.

- Broad Accessibility: With no requirements for employment checks, it’s an accessible option for a broader range of individuals seeking credit.

Disadvantages

- Usage Limitation: The card’s usage is limited specifically to the Horizon Outlet website, reducing its versatility compared to general credit cards.

- Credit Building: Lacks credit building capability, as it does not report to credit bureaus, missing an opportunity to improve credit scores.

- Annual Fee: An annual fee of $177.24 ($14.77 per month) applies, which may be higher compared to some other cards.

- No Rewards: Absence of rewards or cash back programs, limiting the potential for additional savings or incentives on purchases.

- Shipping Costs: Shipping fees for purchases must be paid separately, adding an extra cost to your shopping experience.

- Financial Flexibility: The card does not offer features like cash advances or balance transfers, limiting financial flexibility.

In essence, the Group One Platinum Card is a unique financial instrument tailored for online shopping enthusiasts, especially those with diverse credit backgrounds.

While it offers an easy application process and a notable credit line, it’s crucial to weigh these benefits against its limitations, such as the lack of credit building and rewards.

This card could be a valuable tool in your financial arsenal, especially if its specific offerings align with your shopping habits and credit needs.

Yes, the Group One Platinum Card is exclusively designed for online shopping, but it can only be used at the Horizon Outlet website. This exclusivity makes it a specialized tool for consumers who are frequent shoppers on this particular site, providing a dedicated and secure way to manage online purchases.

Currently, there is no dedicated mobile app available for managing the Group One Platinum Card. Cardholders may need to manage their account and transactions through the card issuer’s website or customer service. It’s essential to keep track of your account regularly, especially for managing payments and reviewing transaction history.

Absolutely, the Group One Platinum Card is tailored for individuals with bad or no credit. It does not require a credit check for approval, making it accessible for those who might struggle to obtain credit through traditional means. This card is especially beneficial for making purchases at the Horizon Outlet website without the complexities involved in conventional credit card approvals.

The Group One Platinum Card does not assist in building credit, as it does not report to credit bureaus. If your goal is to improve your credit score, you might want to consider other financial tools designed for credit building. This card is more suited for those who need a dedicated line of credit for online purchases at the Horizon Outlet, rather than for credit improvement purposes.

The Group One Platinum Card offers a unique $750 credit line, ideal for Horizon Outlet shoppers. It’s a great choice for those needing a simple, credit-check-free solution.

Apply for the Group One Platinum Card

Discover how to apply for the Group One Platinum Card and enjoy effortless shopping with a significant credit limit and no credit checks.

Looking for an alternative? Meet the FIT® Platinum Mastercard®, a credit card designed to aid those with bad credit in building a healthier credit score while offering purchasing power.

The FIT® Platinum Mastercard® stands out with its credit-building capabilities, regular reporting to major credit bureaus, and an initial credit limit that can grow over time.

Eager to learn more? See the following link for more information about the FIT® Platinum Mastercard® and how to apply for it.

Apply for the FIT® Platinum Mastercard®

Thinking to boost your credit? See how to apply for the FIT® Platinum Mastercard® and embark on a journey to financial growth.

Trending Topics

Apply for the Avant Personal Loans: Fund Your Dreams Fast!

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Keep Reading

Apply for the Rocket Personal Loans: Easy Online Process!

Take a leap forward when you apply for the Rocket Personal Loans. It features instant decisions and a hassle-free online application.

Keep ReadingYou may also like

Choose Your Loan Wisely: Unlock the Key to Financial Freedom

Find clarity in choosing the best loan for your needs with our expert guidance, simplifying your journey towards financial security.

Keep Reading

Apply for the Wells Fargo Active Cash® Card: no annual fees ahead

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Keep Reading

$0 annual fee: Petal® 1 “No Annual Fee” Visa® Credit Card review

Review Petal® 1 “No Annual Fee” Visa® Credit Card main features and learn how it works. Earn up to 10% cash back on select merchants!

Keep Reading