Seeking a modern credit solution to boost your credit score to new heights?

Discover the ease of managing your credit journey with the GO2bank Secured Visa® Credit Card!

Advertisement

Get the GO2bank Secured Visa® Credit Card to build credit with a safety net. Your deposit sets your limit, making it a secure choice. Plus, their user-friendly app lets you track progress and manage your finances effortlessly. With activity reported to credit bureaus, it’s a step towards a stronger financial future.

Get the GO2bank Secured Visa® Credit Card to build credit with a safety net. Your deposit sets your limit, making it a secure choice. Plus, their user-friendly app lets you track progress and manage your finances effortlessly. With activity reported to credit bureaus, it’s a step towards a stronger financial future.

You will remain in the same website

Dive below to uncover the GO2bank Secured Visa® Credit Card benefits and how it can reshape your credit journey.

Embark on a credit journey that prioritizes you with the GO2bank Secured Visa® Credit Card.

Crafted with care and precision, this card is not just a payment method—it’s a stepping stone towards financial empowerment and growth.

Advantages and special perks

- Build or Rebuild Credit: The GO2bank Secured Visa® is an excellent tool for those looking to establish or rebuild their credit history, as it reports to all three major credit bureaus.

- Flexible Security Deposit: Tailor your credit limit by choosing a refundable security deposit that fits your budget, allowing for flexibility and adaptability.

- No Hidden Fees: Say farewell to the stress of unexpected fees. With the GO2bank Secured Visa®, what you see is what you get—no hidden charges or surprises.

- Mobile App Integration: Stay connected with your finances on the go. The integrated mobile app offers real-time transaction alerts, account balance checks, and easy payment options.

- Protection First: Benefit from Visa’s Zero Liability Policy, ensuring you’re not held responsible for unauthorized transactions on your card.

- Potential Graduation: Demonstrating responsible card usage and timely payments might make you eligible for an unsecured card in the future.

Disadvantages

- Requires a Security Deposit: As a secured card, an upfront refundable deposit is necessary, which might be a hurdle for some potential cardholders.

- Limited Rewards: Unlike some other credit cards, the GO2bank Secured Visa® doesn’t offer a robust rewards or cashback program.

- APR Considerations: The card might come with a higher APR compared to some unsecured credit cards, emphasizing the importance of timely payments.

- No Balance Transfers: Currently, the card does not support balance transfers, which might be a limitation for those looking to consolidate debt.

The GO2bank Secured Visa® Credit Card emerges as a reliable ally for those on the path to credit enhancement.

While it offers a structured and transparent credit-building avenue, it’s crucial to evaluate its features against individual financial needs.

For those dedicated to building a brighter credit future, this card promises to be a supportive partner.

Unlike many Visa credit cards, the GO2bank Secured version is specially designed to help users build credit effectively and responsibly. Also, manage your card with ease through the dedicated GO2bank app. It offers a user-friendly interface to track spending and payments. Simply use your GO2bank app login credentials to access.

With regular use and timely payments, this card reports to major credit bureaus, supporting your journey to build credit and improve your financial standing.

Your line of credit is determined by your security deposit. This ensures you only spend what you’ve deposited, minimizing risks while building credit.

Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

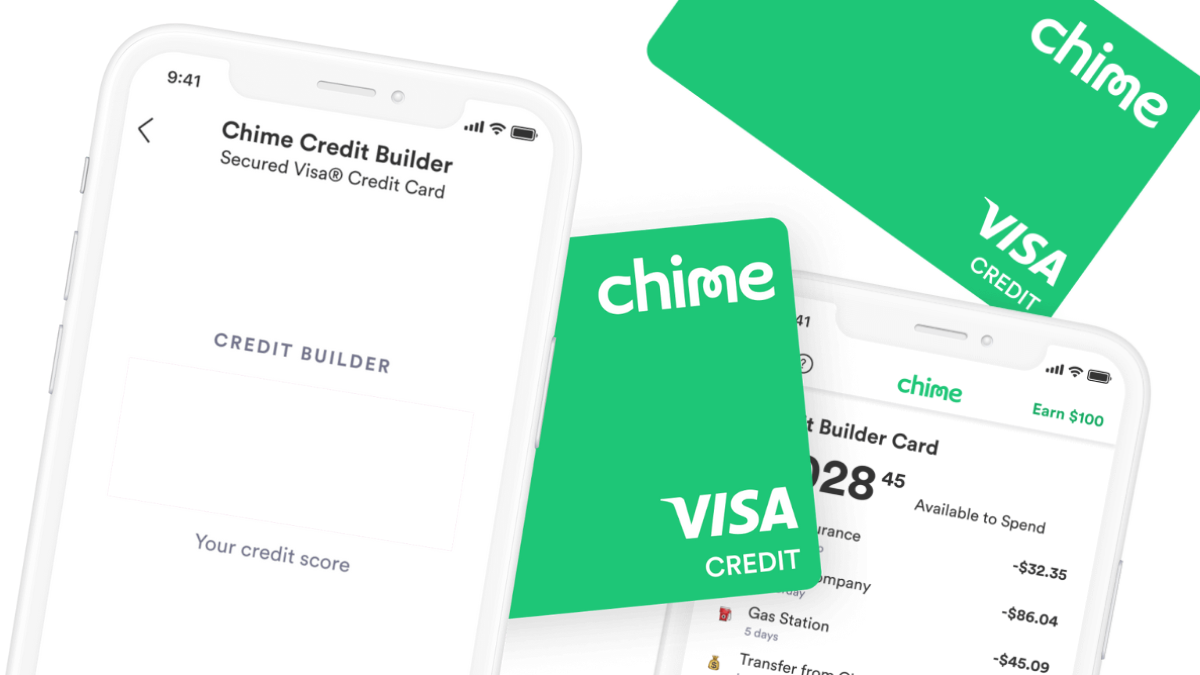

It’s easy to use and packed with handy features. But if you’re exploring other options, the Chime Credit Builder Secured Visa® is worth checking out. This card stands out with its unique way of setting your credit limit.

Interested in a new way to grow credit? Check the following link for a deep dive into the Chime Credit Builder Secured Visa®. Join us on this exciting financial adventure!

Apply for the Chime Credit Builder Secured Visa®

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Trending Topics

Chase Freedom Flex℠ Credit Card Review: 0% APR and Much More!

Explore our Chase Freedom Flex℠ Credit Card review for exclusive cash back rewards & 0% intro APR benefits. Maximize your spending smartly!

Keep Reading

Apply for the First Latitude Secured Mastercard® Credit Card

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

Keep Reading

Credit builder: Apply for First Digital Mastercard® Credit Card

The process to apply for the First Digital Mastercard® Credit Card is simple and quick! Earn 1% cash back on payments and build credit fast!

Keep ReadingYou may also like

Up to 3% back: Amazon Rewards Visa Signature Card review

This Amazon Rewards Visa Signature Card review offers Amazon lovers an excellent card option! $0 annual or foreign transaction fees!

Keep Reading

Apply for the PREMIER Bankcard® Mastercard® Credit Card today

Learn how to apply for the PREMIER Bankcard® Mastercard® Credit Card and start building credit fast! Keep reading and learn everything!

Keep Reading