Credit Card

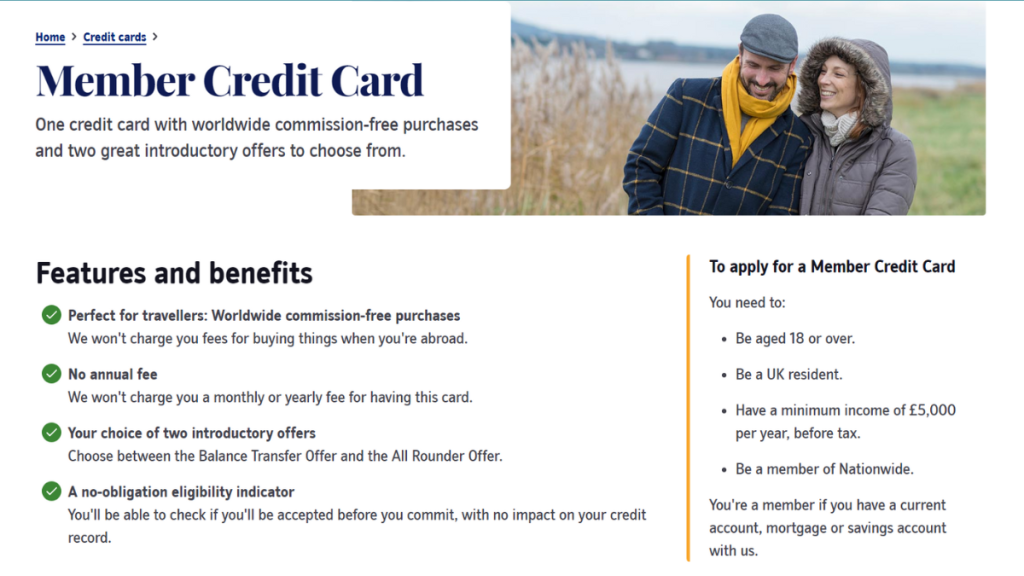

Nationwide Member Credit Card review: Worry-Free Spending

Say goodbye to complicated rewards programs and hello to worry-free spending with the Nationwide Member Credit Card. Pay no annual fee!

Advertisement

0% APR in the first 12 months

The Nationwide Member Credit Card is a straightforward, no-frills credit card offering simplicity and peace of mind, as you’ll see in our review.

Apply for the Nationwide Member Credit Card

Apply for the Nationwide Member Credit Card with confidence using our step-by-step guide. Ensure a hassle-free experience!

This is a reliable option for those who want a credit card that won’t cause any headaches. So, let’s take a closer look at the features and benefits of this card.

| Credit Score | Not disclosed; |

| Annual Fee | £0; |

| Purchase APR | 0% APR on purchases for months; 19.9% (variable); |

| Cash Advance APR | Not disclosed; |

| Welcome Bonus | None; |

| Rewards | None. |

Nationwide Member Credit Card: All you need to Know

The Nationwide Member Credit Card is an option that offers simplicity and ease of use for worry-free spending.

However, with no annual fee and a welcome bonus of 0% APR for 15 months, it’s a great option for those who want a straightforward card.

In addition to its simplicity, the Nationwide Member Credit Card offers advanced fraud protection features.

So it includes 24/7 monitoring and zero liability for fraudulent transactions.

Indeed, this can provide peace of mind for those worried about their credit card information security.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Nationwide Member Credit Card

The Nationwide Member Credit Card is issued by Nationwide Building Society, a UK-based financial institution that has been around since 1846.

Moreover, the card is designed to offer simplicity and ease of use, with no complicated rewards programs or cashback offers to worry about.

Pros

- No annual fee: With no annual fee, you won’t have to worry about paying any extra charges just to have the card;

- 0% APR for 18 months on balance transfers and for 15 months on purchases;

- Fraud protection: The Nationwide Member Credit Card has advanced fraud protection features, including 24/7 monitoring and zero liability for fraudulent transactions.

Cons

- No rewards: While some may see this as a benefit, those who want to earn rewards or cashback on their purchases may be disappointed with the lack of rewards offered by the Nationwide Member Credit Card.

What credit score do you need to apply?

The Nationwide Member Credit Card does not disclose any specific credit score requirements for approval.

However, like with any credit card application, having a good credit score is important to increase your chances of approval.

A good credit score is generally considered 670 or higher, while an excellent credit score is 800 or higher.

How to easily apply for the Nationwide Member Credit Card?

The Nationwide Member Credit Card is a reliable and straightforward credit card option for those who want simplicity and ease of use.

With no annual fee and a welcome bonus of 0% APR for 15 months, it’s a great option for those who want to transfer balances.

So, do you want to know to learn how to apply? Finally, check the post below.

Apply for the Nationwide Member Credit Card

Apply for the Nationwide Member Credit Card with confidence using our step-by-step guide. Ensure a hassle-free experience!

About the author / Sabrina Paes

Trending Topics

Apply for the First Access Visa® Card: Free credit score access

Discover how to easily apply for the First Access Visa® Card and make the right credit move with our simple step-by-step guide.

Keep Reading

Apply for the Rocket Personal Loans: Easy Online Process!

Take a leap forward when you apply for the Rocket Personal Loans. It features instant decisions and a hassle-free online application.

Keep Reading

Chime® Debit Card review: Experience Hassle-Free banking

Explore the Chime® Debit Card - our in-depth review uncovers its benefits and features! Simplify your finances today!

Keep ReadingYou may also like

Maximized earnings: Apply the Capital One Walmart Rewards® Card

Looking to apply for the Capital One Walmart Rewards® Card? We've got you covered! Read on and discover how to earn unlimited cash back!

Keep Reading

$0 annual fee: Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Keep Reading

Make Smart Choices: Discover the Top Cards for Poor Credit

Discover which are the best credit cards for poor credit – improve your financial future with our expert recommendations and tips today!

Keep Reading