Debt & Credit Free

Home Equity Loans

Advertisement

Home equity is the term utilized for the value of the home, which is not used as collateral for the home loan. Home equity loans are home equity loans that allow an individual to borrow against the value of their homes. Home equity loans are essentially a type of second mortgage on your home, and as a result, it is called home equity loan.

The term home equity means the individual or family sells something that has increased in value to be able to clear some of their debt. It is not easy to sell things increasing the value of something like a car or boat; it requires a massive amount of money. If you decide to sell your car, the only way you can do to Lad formally is to have a type of ‘less’ income in the house.

Many agencies advertise loans at a higher percentage rate of interest but combine it with other considerations like these loans have to have a basis and other costs like divorce and credit information. Loan companies would like to see that you have been making home improvements for some years; there is no time limit, and the loans have to be well documented. Home equity loans arise when the existing mortgage balance is less than the home value.

The collateral for Home equity loans is normally the house itself. To find out the actual value of your home, calculate the value of the house with what it is still worth, then subtract some percentage for any liens or mortgages. Each additional amount that is subtracted increases the value of the home; the more you are borrowed is added to the value of the existing property.

With a home equity loan, you can borrow money because the collateral is the house itself. However, some risks should be considered. A home is something that a family gets to own. They will make money on it; however, they are also in debt because of the payments of the loan. It would be better if they could consolidate some of their debt at smaller interest rates to avoid large amounts of money to pay.

Home Equity Loans are two simple documents needed to apply for a loan. The first is a loan application which can be submitted either in person or over the internet. The interest rate and payments are worked out once the going market rates have been calculated. The interest rates can be lower and even tax-deductible too. Once a home equity loan has been approved, like any other loan, the payments are made the same way, every month.

There are so many companies wanting to give out home equity loans. There are a few different reasons that home equity is worth the risk. It is the perfect loan of last resort and almost the safest type of loan because it is backed up by your own house. If you spend money and have nothing to pay back, your house is your backup. In the unfortunate instance of you defaulting on the payments, you could lose your home.

Home Equity Loans Broker Australia is the perfect place to accomplish home mortgage loans because they can help you examine the loan packages available and give you advice as well as the cheapest and best loan for your specific circumstances. They will also guide you in the process of applying for a loan and try to help you through the confusion of loan applications.

Trending Topics

Apply for Chase Freedom Unlimited® Credit Card: $0 annual fee

Learn how to apply for the Chase Freedom Unlimited® Credit Card and explore its benefits - maximize rewards and savings effortlessly!

Keep Reading

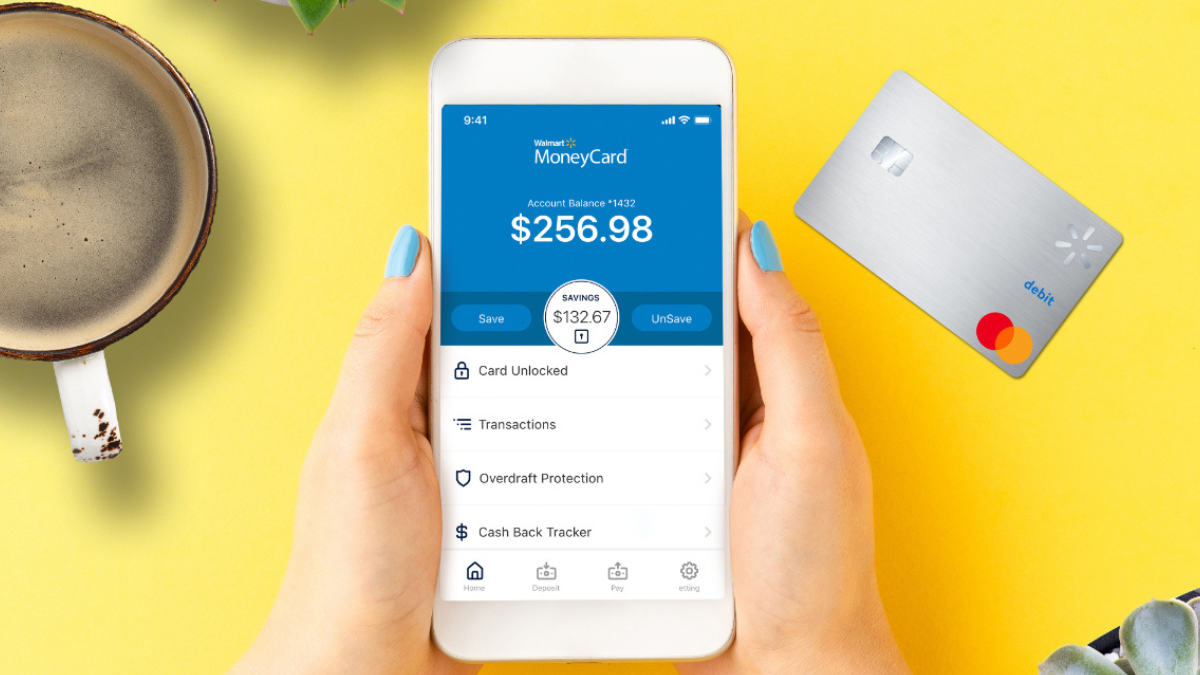

Walmart MoneyCard review: Earn cash back at Walmart

Explore our Walmart MoneyCard review to uncover features and how it can redefine your shopping experience today - earn 2% APY on savings.

Keep Reading

Hassle-free: Apply for Chime Credit Builder Secured Visa® Card

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Keep ReadingYou may also like

Can an Overdraft Affect Your Credit Score?

Does overdraft affect your credit score? Learn facts and tips to protect your financial health and credit rating. Stay informed and secure.

Keep Reading

Apply for First Progress Platinum Prestige Secured Card: 1% back

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

Keep Reading

First Access Visa® Card review: Earn 1% back on card payments!

Explore our detailed First Access Visa® Card review to learn about its features and benefits. Earn 1% cash back on purchases and more!

Keep Reading