Credit Card

How to apply for the First Progress Platinum Select Mastercard® Secured

Step into a world of credit-building with our guide on how to apply for the First Progress Platinum Select Mastercard® Secured Credit Card! Keep reading.

Advertisement

Secure your financial path and grow a strong credit foundation!

Navigating the financial seas can be daunting, but to apply for the First Progress Platinum Select Mastercard® Secured is a step towards calm waters.

To help you on this journey, we’ve mapped out the application process for you. So read on to learn how to apply and uncover the benefits of this card.

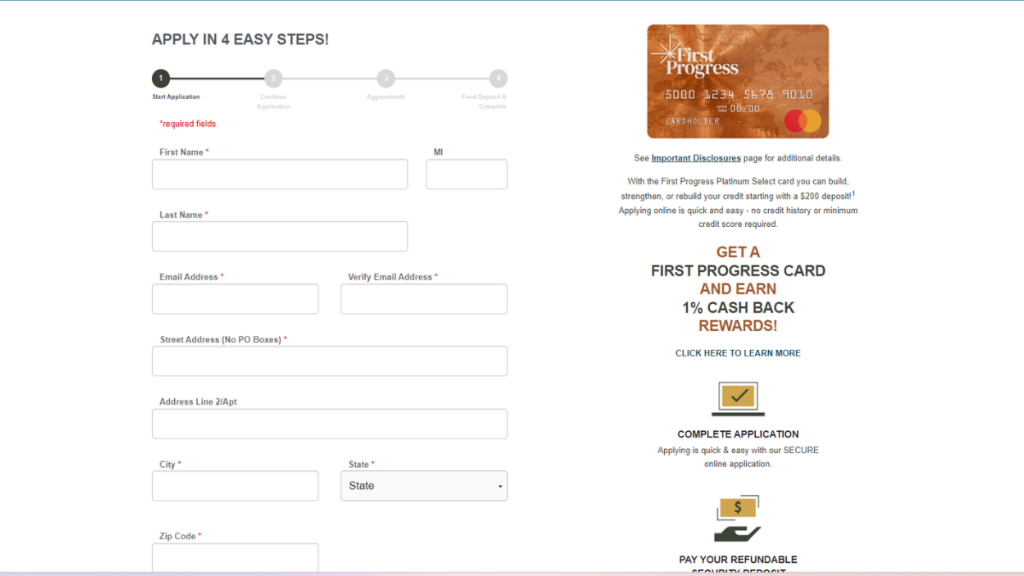

Online application

When you choose to apply for the First Progress Platinum Select Mastercard® Secured online, you’re choosing a simple way to improve your rating.

Then, step into the First Progress homepage and look for the Platinum Select Mastercard® option. Found it? Now select the “apply now” button.

Fill in all the requested details on the application form, such as personal information, financial details, and your desired security deposit amount.

After submission, you might receive an instant decision, or it may take a few days. Stay tuned on your email for any follow-ups or additional verification.

If approved, you’ll receive instructions regarding your security deposit and card activation. Follow them to begin enjoying the benefits of your new card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

The only way you can request this card is online, which makes the process efficient and straightforward.

It’s a hassle-free way to secure a card that can help improve your credit.

So applying through their official website is a safe method, protecting you from potential fraud and ensuring a reliable path to better financial health.

First Progress Platinum Select Mastercard® Secured Credit Card or GO2bank Secured Visa® Credit Card?

As we’ve seen, the First Progress Platinum Select Mastercard® Secured is a reliable and user-friendly tool that can help you reach new credit heights.

However, if you’re looking for an annual-fee free card, the GO2bank Secured Visa® Credit Card is a great alternative.

This, with no credit checks and great credit-building capabilities. It’s a valuable option for those exploring different credit solutions.

Compare both cards below to weigh them against each other and decide which option aligns with your financial goals and needs.

| First Progress Platinum Select Mastercard® Secured Credit Card | GO2bank Secured Visa® Credit Card | |

| Credit Score | All scores are invited to apply. | There are no credit checks on existing account holders, so everyone is welcome to apply. |

| Annual Fee | You’ll have to pay $39 to own this credit building tool. | There’s no annual fee for the GO2bank Secured Card. |

| Purchase APR | 19.24% variable. | 22.99%. |

| Cash Advance APR | 25.24% variable. | 26.99%. |

| Welcome Bonus | Currently, there are none. | None. |

| Rewards | Earn 1% back on purchases when you pay your balance. | This is not a rewards card, so there are none. |

So, is the GO2bank Secured Visa® Credit Card a better fit for how you want your credit building path to go?

Then explore the following article to learn more about how it can help you.

Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Trending Topics

Apply for the FIT® Platinum Mastercard®: Unlock Better Credit!

Thinking to boost your credit? See how to apply for the FIT® Platinum Mastercard® and embark on a journey to financial growth.

Keep Reading

$0 annual fee: Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Keep Reading

Things that might happen if you don’t use your credit card!

Have you ever wondered what happens if you don't use your credit card? Don't worry! We'll explain everything your need here! Keep reading!

Keep ReadingYou may also like

Apply for the OneMain Financial Personal Loans: Fast Funding!

Secure your financial needs; apply for OneMain Financial Personal Loans for quick funding solutions and accessible branch support near you.

Keep Reading

Transunion vs. Equifax: the credit reporting giants

Transunion vs. Equifax are different credit report agencies that provide your credit score! But how do they differ? Keep reading and learn!

Keep Reading

Rebuild Your Credit Score: Choose the Perfect Cards for Bad Credit

Discover the best credit cards for bad credit. Boost your financial journey and improve your score with our trusted options.

Keep Reading